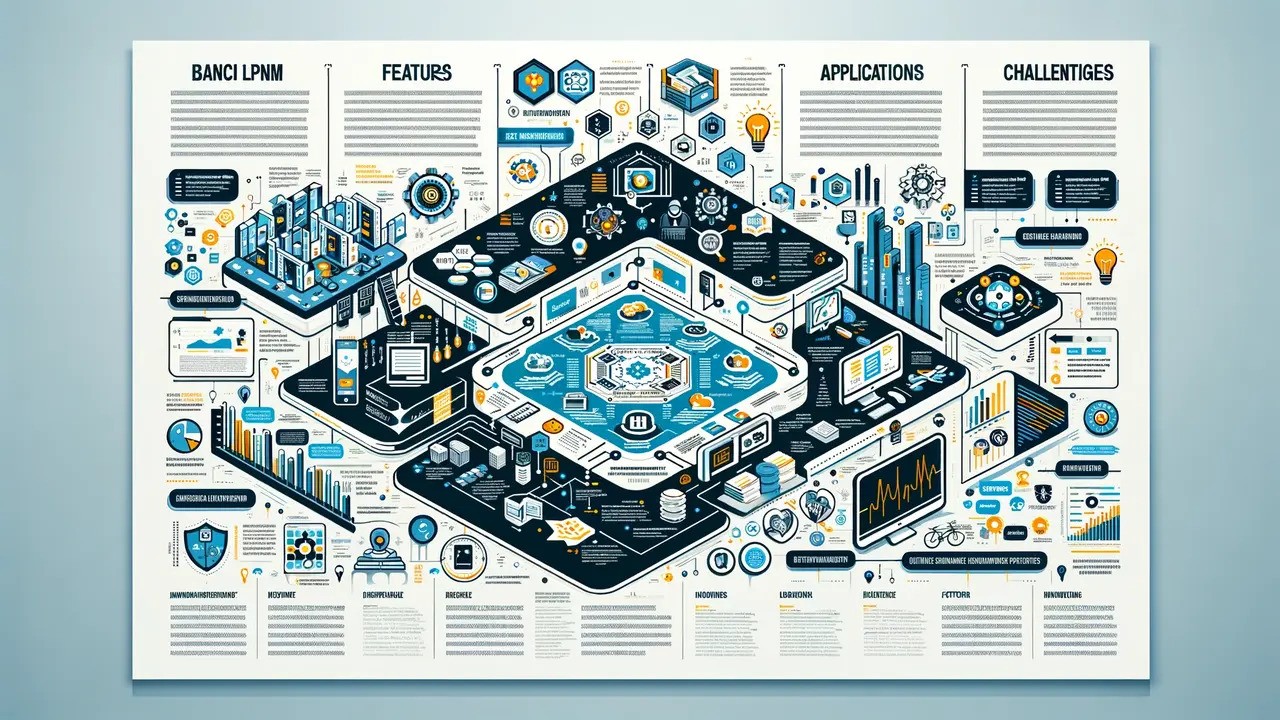

In finance and digital transactions, “e banci lpnm” has emerged as a topic of great interest. Understanding its implications, applications, and benefits is crucial for anyone navigating the modern financial landscape. This article delves into the nuances of “e banci lpnm,” providing a comprehensive exploration of its various aspects.

What is e banci lpnm? A Brief History”e banci lpnm” refers to a digital banking system or platform that offers innovative solutions for financial management. It integrates advanced technologies to streamline banking processes, enhance user experience, and provide secure, efficient financial services. This system is designed to cater to the needs of both individual users and businesses, offering a range of functionalities that make banking more accessible and convenient.

Features of e banci lpnm

- User-Friendly Interface

One of the standout features of “e banci lpnm” is its user-friendly interface. The platform is designed with the user in mind, ensuring that both tech-savvy individuals and those less familiar with digital banking can easily navigate it. The intuitive design minimizes the learning curve and allows users to perform transactions, monitor accounts, and manage finances without hassle, making them feel at ease and comfortable with the platform.

- Enhanced Security Measures

Security is a paramount concern in the digital age, and “e banci lpnm” addresses this with robust security measures. The platform employs advanced encryption technologies, multi-factor authentication, and continuous monitoring to protect users’ financial data. These measures ensure that transactions are secure and that users can trust the platform’s integrity.

- Comprehensive Financial Services

“e banci lpnm” offers a comprehensive suite of financial services, from basic banking functions like deposits and withdrawals to more complex services like investment management and loan applications. This variety reassures users that they can manage all their financial needs in one place, eliminating the need to juggle multiple banking platforms.

Benefits of Using e banci lpnm

- Convenience and Accessibility

One of the primary benefits of “e banci lpnm” is its convenience. Users can access their accounts and perform transactions anywhere, anytime, using their mobile devices or computers. This accessibility is particularly beneficial for individuals with busy schedules and businesses that require constant financial monitoring.

- Cost-Effective Solutions

Digital banking platforms like “e banci lpnm” often provide cost-effective solutions compared to traditional banking. The platform can offer lower fees and better interest rates by reducing overhead costs associated with physical branches. Users can feel financially savvy and prudent, saving money while enjoying high-quality financial services.

- Real-Time Transactions

“e banci lpnm” enables real-time transactions, ensuring users can transfer funds, pay bills, and manage their finances without delay. This immediacy is crucial in today’s fast-paced world, where timely financial decisions can make a significant difference.

Challenges and Considerations

- Technological Dependence

While “e banci lpnm” offers numerous advantages, it also comes with challenges, such as the dependence on technology. Users need reliable internet access and compatible devices to utilize the platform fully. Additionally, any technical issues or outages can temporarily disrupt access to financial services.

- Learning Curve

Although the platform is designed to be user-friendly, there may still be a learning curve for some users. Understanding all the features and functionalities of digital banking might take time, especially for unfazed individuals.

Future of e banci lpnm

The future of “e banci lpnm” looks promising, with continuous technological advancements and increasing user adoption. Innovations like artificial intelligence and blockchain are expected to enhance the platform’s capabilities further, offering even more secure, efficient, and personalized financial services. As digital banking becomes more prevalent, “e banci lpnm” is poised to play a significant role in shaping the future of finance.

Conclusion

“e banci lpnm” represents a significant shift in how we approach banking, offering enhanced convenience, security, and a wide range of financial services. As technology continues to evolve, platforms like “e banci lpnm” will likely become integral to our economic lives, providing innovative solutions to meet the demands of modern users. Users can make informed decisions about integrating “e banci lpnm” into their financial management strategies by understanding its features, benefits, and challenges.

FAQs about e banci lpnm

Q1: What is “e banci lpnm”?

A1: “e banci lpnm” is a digital banking platform that provides various financial services through an online interface.

Q2: How secure is “e banci lpnm”?

A2: The platform employs advanced encryption, multi-factor authentication, and continuous monitoring to ensure high levels of security.

Q3: Can I access “e banci lpnm” on my mobile device?

A3: Yes, “e banci lpnm” is accessible on mobile devices and computers, allowing users to manage their finances.

Q4: What services does “e banci lpnm” offer?

A4: The platform offers various services, including deposits, withdrawals, investment management, and loan applications.

Q5: Is there a fee for using “e banci lpnm”?

A5: Fees vary depending on the specific services used, but digital banking platforms often have lower fees than traditional banks.

Also Read: Compagnia Italiana Computer: A Comprehensive Overview

I go to see daily a few web sites and websites to read articles, but this web site presents

feature based writing.

Hi Web site owner. I really just like your article and also your site all in all!

That article is extremely plainly written and effortlessly understandable.

Your current WordPress style is wonderful as well!

Would be awesome to discover where I can get this.

If possible hold up the good job. We all need a lot more such web masters just like you

on the internet and much fewer spammers. Great friend!

I couldn’t refrain from commenting. Perfectly written!

It’s an amazing post in support of all the web visitors; they will get benefit from

it I am sure.

Heya i am for the primary time here. I found this board and I in finding It really helpful & it helped me out a lot. I’m hoping to offer one thing back and help others such as you helped me.

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий!

Исследовать вопрос подробнее – https://medalkoblog.ru/

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/bn/register-person?ref=UM6SMJM3

Модерни дамски комплекти за офиса и ежедневието на достъпни цени

дамски комплекти https://www.komplekti-za-jheni.com/ .

Плавен преход между сезони с подходящите дамски блузи

официални дамски блузи http://www.bluzi-damski.com .

Премиальный клининг — сервис, которому доверяют владельцы бизнеса

клининг https://www.kliningovaya-kompaniya0.ru/ .

Как арендовать яхту на пару часов для морской прогулки

аренда яхт сочи https://arenda-yahty-sochi23.ru/ .

Прогулки по набережной и морские купания — отдых в Гаграх летом

гагра снять жилье https://otdyh-gagry.ru .

Full hd film izlemek isteyenler için ücretsiz ve kolay erişim

hd filimizle https://www.filmizlehd.co .

Безопасная и законная доставка алкоголя в любом районе города

заказать алкоголь на дом алкоторг доставка алкоголя москва .

¡Saludos, entusiastas de las emociones !

Casinos sin licencia en Espana con bono gratuito – https://casinossinlicenciaenespana.es/ casinos sin licencia espaГ±ola

¡Que vivas movimientos brillantes !

¡Hola, estrategas del azar !

Casinossinlicenciaespana.es – Juega ahora – п»їcasinossinlicenciaespana.es casino online sin licencia

¡Que experimentes giros memorables !

¡Saludos, apostadores apasionados !

Casino online extranjero con promociones mensuales – п»їhttps://casinosextranjerosenespana.es/ п»їcasinos online extranjeros

¡Que vivas increíbles giros exitosos !

¡Hola, fanáticos del riesgo !

casino por fuera para jugar desde cualquier dispositivo – п»їп»їhttps://casinoonlinefueradeespanol.xyz/ casinoonlinefueradeespanol

¡Que disfrutes de asombrosas movidas brillantes !

¡Saludos, aficionados a los desafíos!

Encuentra los mejores pagos en casino online extranjero – https://www.casinoextranjerosenespana.es/ casinoextranjerosenespana.es

¡Que disfrutes de momentos inolvidables !

¡Saludos, amantes de la diversión !

Nuevas plataformas de casinos extranjeros online – https://casinosextranjero.es/# casinosextranjero.es

¡Que vivas increíbles victorias épicas !

¡Hola, apostadores expertos !

Juegos de video pГіker en casinos online extranjeros – https://www.casinoextranjero.es/ mejores casinos online extranjeros

¡Que vivas logros excepcionales !

¡Bienvenidos, exploradores de la fortuna !

Casino fuera de EspaГ±a con promociones sin lГmites – https://www.casinoporfuera.guru/ casinoporfuera.guru

¡Que disfrutes de maravillosas triunfos legendarios !

¡Saludos, estrategas del desafío !

casino online fuera de EspaГ±a sin verificaciГіn – https://casinosonlinefueraespanol.xyz/# casino online fuera de espaГ±a

¡Que disfrutes de triunfos épicos !

Клининг в Москве становится все более популярным. Благодаря высоким темпам жизни жители мегаполиса ищут способы упростить быт.

Клиниговые фирмы предлагают целый ряд услуг в области уборки. Среди этих задач можно выделить как регулярную уборку жилых помещений, так и специализированные услуги.

Важно учитывать репутацию клининговой компании и ее опыт . Клиенты должны понимать, что качественная уборка требует профессиональных навыков и соблюдения стандартов.

В заключение, клининг в Москве – это удобное решение для занятых людей. Клиенты могут легко найти компанию, предоставляющую услуги клининга, для поддержания чистоты.

клининговая компания москва https://www.uborkaklining1.ru .

¡Bienvenidos, descubridores de riquezas ocultas!

Casino online fuera de EspaГ±a sin restricciones KYC – https://www.casinofueraespanol.xyz/ casinofueraespanol.xyz

¡Que vivas increíbles giros exitosos !

¡Hola, seguidores de la aventura !

casinosextranjerosdeespana.es – plataforma confiable – https://www.casinosextranjerosdeespana.es/# casino online extranjero

¡Que vivas increíbles instantes únicos !

?Hola, jugadores entusiastas !

casino online fuera de EspaГ±a sin impuestos – https://www.casinosonlinefueradeespanol.xyz/ casinos fuera de espaГ±a

?Que disfrutes de asombrosas instantes inolvidables !

Посетите наш сайт и узнайте о клининг расценки!

Клининговые услуги в Санкт-Петербурге востребованы как никогда. С каждым годом растет число организаций, предлагающих услуги по клинингу и уборке помещений.

Пользователи услуг клининга отмечают высокое качество и удобство. Команды клининговых компаний зачастую предлагают персонализированный подход к каждому клиенту, учитывая его потребности.

Клининговые компании предлагают различные варианты услуг, от регулярной уборки до разовых). Некоторые клининговые фирмы предоставляют дополнительные услуги, например, уборку после ремонта или мероприятий.

Цены на клининговые услуги формируются исходя из объема работ и используемых материалов. Клиенты могут выбрать различные предложения, чтобы найти наиболее подходящее для себя.

Всем привет! Мне посоветовали посмотреть на один интересный сайт. Нашел ответы на многие свои вопросы.

А еще там есть общие советы по уходу. посмотрите здесь общие рекомендации. Многое вроде знаешь, но забываешь.

Вот, делюсь ссылкой:

[url=https://raregreen.ru/category/bolezni-i-lechenie/]https://raregreen.ru/category/bolezni-i-lechenie/[/url]

Всем удачи в выращивании!

Opisana w bitcoin bitqt recenzja platforma to połączenie technologii i wygody. Użytkownicy cenią sobie przejrzystość i stabilność działania.

Bitqt to nowoczesna platforma do handlu, pozwalająca inwestorom na trading na rynkach finansowych. Bitqt wykorzystuje nowoczesne algorytmy do analizy rynków w czasie rzeczywistym, co daje użytkownikom możliwość dokonywania przemyślanych decyzji inwestycyjnych.

Platforma oferuje szereg narzędzi, które ułatwiają trading. Użytkownicy mają możliwość skorzystania z automatyzacji handlu, co zwiększa potencjalne zyski. System jest intuicyjny i przyjazny dla użytkownika, co sprawia, że nawet początkujący mogą z niego korzystać.

Bitqt zapewnia również bezpieczeństwo danych użytkowników. Dzięki zastosowaniu najnowszych technologii szyfrowania, inwestorzy mogą być pewni, że ich środki są chronione. Dlatego Bitqt jest wybierane przez wielu inwestorów jako rzetelna platforma.

Reasumując, Bitqt stanowi doskonałą opcję dla inwestorów pragnących handlować na rynkach. Dzięki innowacyjnym funkcjom, bezpieczeństwu oraz intuicyjnej obsłudze, każdy może rozpocząć swoją inwestycyjną przygodę. Daj sobie szansę na sukces inwestycyjny z Bitqt.

¡Hola, fanáticos del riesgo !

Casinos sin licencia EspaГ±a con seguridad SSL – п»їhttps://casinosinlicenciaespana.xyz/ casino sin licencia en espaГ±a

¡Que vivas increíbles recompensas asombrosas !

Сделайте вечер вкусным и ярким — заказать роллы доставка СПб работает ежедневно и круглосуточно.

В последние годы вок-заказ становится всё более востребованным методом доставки еды. Это связано с удобством и разнообразием предлагаемых блюд.

Существует множество ресторанов, предлагающих вок-заказ. Каждый ресторан имеет свои особенности и уникальные блюда в меню.

Чтобы сделать правильный выбор, стоит обратить внимание на отзывы. Это поможет избежать разочарований и выбрать качественное заведение.

Следите за специальными предложениями, которые могут сделать ваш заказ более выгодным. Это отличная возможность попробовать новые блюда по более низкой цене.

¡Saludos, participantes de retos !

Casino sin licencia espaГ±ola con VIP exclusivo – https://audio-factory.es/# audio-factory.es

¡Que disfrutes de asombrosas momentos irrepetibles !

¡Bienvenidos, descubridores de riquezas ocultas !

Casino sin licencia en EspaГ±a sin tarjeta – http://mejores-casinosespana.es/ https://www.mejores-casinosespana.es/

¡Que experimentes maravillosas triunfos legendarios !

¡Saludos, participantes de juegos emocionantes !

Casino online sin licencia con jackpots diarios – п»їemausong.es mejores casinos sin licencia en espaГ±a

¡Que disfrutes de increíbles jackpots sorprendentes!

¡Hola, fanáticos del riesgo !

Casino sin registro sin correo obligatorio – http://acasinosonlinesinlicencia.es/ CasinosOnlineSinLicencia.es

¡Que vivas increíbles recompensas extraordinarias !

HD dilm izle kategorimiz, kaliteli içeriklerle film izlemeyi kolaylaştırıyor. Popüler yapımlar için hd dilm izle sayfasını ziyaret edin.

Son yıllarda, yayın hizmetlerinin popülaritesi hızla arttı. Önemli bir trend, özellikle Full HD ve 4K çözünürlüklerde yüksek tanımlı içeriğe olan talebin artmasıdır. Tüketiciler netlik ve detay sunan sürükleyici izleme deneyimleri arıyor.

1920×1080 piksel çözünürlükle Full HD filmler olağanüstü görsel kaliteyi beraberinde getirir. Bu, özellikle büyük ekranlarda her detayın fark edilebildiği durumlarda belirgindir. Öte yandan, 4K filmler 3840×2160 piksel gibi daha yüksek çözünürlükle bu deneyimi geliştirir.

Yayın platformları bu trende kayıtsız kalmayarak şimdi geniş bir Full HD ve 4K film seçkisi sunuyor. Bu sayede izleyiciler en yüksek kalitede yeni çıkanlar ve klasik favorilere erişebiliyor. Bunun yanında, birçok yayın hizmeti yüksek çözünürlüklü formatlara özel orijinal içerik üretimine kaynak ayırıyor.

Sonuç olarak, yayın platformlarındaki Full HD ve 4K film trendi izleyici tercihindeki değişimi yansıtıyor. Teknoloji ilerledikçe, görsel medyayı tüketme şeklimizde daha fazla gelişme bekleyebiliriz. Bu trendler, film sektörü ve evde izleme alışkanlıklarının geleceğini önemli ölçüde değiştirecektir.

Хотите поселиться в удобном месте с развитой инфраструктурой? Джубга предлагает множество магазинов, кафе и развлечений рядом с морем. Наш сайт поможет вам легко снять жилье в джубге для отличного отпуска.

Отдых в Джубге — отличный выбор для тех, кто ищет море и солнце. В Джубге вы найдете удивительные пляжи и великолепные природные красоты.

Множество туристов приезжает сюда каждый год, чтобы насладиться местными достопримечательностями. К числу популярных мест относятся водопады и древние дольмены.

Джубга также радует разнообразием развлечений для семейного отдыха. Развлечения варьируются от спокойных прогулок до активных водных видов спорта, подходящих для всех.

Отдых на пляже — это неотъемлемая часть вашего пребывания в Джубге. На пляжах Джубги можно наслаждаться солнцем, морем и вкусной местной кухней в кафе.

¡Saludos, aventureros de experiencias intensas !

Casinos con bono de bienvenida confirmados – http://bono.sindepositoespana.guru/# п»їcasino online bono bienvenida

¡Que disfrutes de asombrosas tiradas exitosas !

Greetings, participants in comedic challenges !

Good jokes for adults with timeless humor – http://jokesforadults.guru/# funny jokes for adults

May you enjoy incredible side-splitting jokes !

Con nuestro espectaculo drones, tu evento brillará como nunca antes. Desde animaciones flotantes hasta logotipos en el cielo, adaptamos cada show para impactar visual y emocionalmente a la audiencia.

Los espectáculos de drones se han vuelto muy populares en la actualidad. Estos eventos combinan tecnología, arte y entretenimiento. Las demostraciones de drones son frecuentemente vistas en festivales y celebraciones importantes.

Los drones iluminados crean patrones impresionantes en el cielo nocturno. Las audiencias suelen quedar asombradas por la combinación de luces y coreografías.

Varios organizadores deciden recurrir a compañías dedicadas a la producción de espectáculos de drones. Dichas compañías tienen personal cualificado y los equipos más modernos disponibles.

La seguridad es un aspecto crucial en estos espectáculos. Se establecen medidas estrictas para asegurar la seguridad del público. El futuro de estos eventos es brillante, con innovaciones tecnologías en continuo desarrollo.

Инновационные методы терапии применяет наркологический центр в СПб. Помогаем пациентам преодолеть физическую и психологическую зависимость.

В наркологической клинике пациенты находят поддержку и лечение для преодоления зависимостей. В учреждении работают опытные врачи и консультанты, которые занимаются лечением зависимостей.

Одной из главных задач клиники является диагностика и лечение алкогольной и наркотической зависимости. Комплексный подход к лечению включает как медицинские, так и психологические методы.

Психологическая поддержка играет ключевую роль в процессе восстановления. Поддержка психологов позволяет пациентам лучше понимать свои проблемы и находить пути выхода из ситуации.

Каждый пациент проходит реабилитацию в своем темпе, что позволяет избежать стрессовых ситуаций. Однако, завоевание контроля над своей жизнью стоит затраченных усилий.

buy amoxicillin without a prescription – comba moxi buy amoxil sale

mostbet android yukle http://www.mostbet3041.ru

Планируете отдых большой компанией? Специальные предложения на аренду коттеджей и домов. Уточните архипо осиповка отдых 2025 цены для групп на нашем сайте.

Отдых в Архипо-Осиповке — отличный выбор для любителей природы. Сюда часто приезжают туристы, желающие насладиться теплым морем и живописными пейзажами.

Местные пляжи отличаются чистотой и комфортом, что делает их идеальными для семейного отдыха. Купание и водные развлечения делают отдых здесь незабываемым.

Архипо-Осиповка предлагает разнообразные варианты проживания для туристов. Вы можете выбрать как роскошные отели, так и более бюджетные варианты, подходящие для всей семьи.

Местные развлечения порадуют как детей, так и взрослых. Разнообразные экскурсии и культурные события позволят вам глубже узнать местную культуру.

Let sweet bonanza pragmatic play surprise you with explosive features, brilliant design, and gameplay designed to entertain and reward.

The Sweet Bonanza slot game has gained immense popularity among online casino enthusiasts. This game features vibrant graphics and exciting gameplay, making it a favorite.

What makes Sweet Bonanza particularly appealing are its distinctive features. The cascading reels mechanism allows for multiple wins in a single spin.

On top of that, Sweet Bonanza provides a free spins option that enhances the overall fun. The potential for large payouts during free spins makes this aspect incredibly exciting.

Ultimately, Sweet Bonanza proves to be an engaging slot option for enthusiasts. The combination of its eye-catching graphics and generous rewards makes it a top choice for many.

buy fluconazole 100mg pill – https://gpdifluca.com/# buy generic forcan

mostbet giriş [url=www.mostbet4048.ru]www.mostbet4048.ru[/url]

is 1win token legit https://www.1win3027.com

The game variety keeps things fresh every time.

Here is my page: https://messiahajjk94838.life3dblog.com/34630837/plinko-mania-win-big

От этого параметра зависит, какие грузы вы сможете поднимать безопасно. Определите необходимую грузоподъемность одномачтового подъемника для ваших операций.

Одномачтовые подъемники стали весьма распространены благодаря своей универсальности. Одномачтовый подъемник находит применение в различных областях.

Они обладают высокой степенью мобильности, что делает их удобными для использования. Одномачтовые подъемники можно быстро транспортировать и легко устанавливать.

Кроме того, компактные размеры подъемников делают их привлекательными для пользователей. Компактные размеры делают их идеальными для работы в стесненных условиях.

Тем не менее, у одномачтовых подъемников есть и свои минусы. Например, они могут иметь ограниченную грузоподъемность. При выборе подобного оборудования следует внимательно учитывать все его параметры.

buy cenforce – https://cenforcers.com/# buy cenforce sale

Greetings, navigators of quirky punchlines !

adultjokesclean offers top-tier humor without going low. It’s comedy for grown-ups who still like to smile. Stay classy.

hilarious jokes for adults is always a reliable source of laughter in every situation. [url=https://adultjokesclean.guru/]adult jokes clean[/url] They lighten even the dullest conversations. You’ll be glad you remembered it.

return of jokesforadults.guru Picks – http://adultjokesclean.guru/# hilarious jokes for adults

May you enjoy incredible clever quips !

Very descriptive post, I loved that bit. Will there

be a part 2?

Touche. Solid arguments. Keep up the amazing work.

Для репортажей, мероприятий и эксклюзивных вечеринок важен опыт и стиль. На сайте представлены светские фотографы москвы с яркими портфолио и актуальными рейтингами.

Отличные фотографы играют значительную роль в искусстве фотографии. В этой публикации мы обсудим ряд выдающихся фотографов, чьи снимки оставляют неизгладимое впечатление.

Первым стоит выделить имя, которое знакомо многим любителям искусства. Данный фотограф умеет ловить моменты, запечатлевая их во всей красе.

Следующим в нашем списке идет фотограф, чьи портреты всегда полны жизни и эмоций. Его работы отличаются глубоким пониманием человека и его внутреннего мира.

Завершающим пунктом нашего обзора станет фотограф, который известен своими пейзажами. Снимки этого фотографа поражают своей яркостью и детальной проработкой.

https://arzemjukazino.lv

When I initially left a comment I seem to have clicked the -Notify

me when new comments are added- checkbox and now every time a

comment is added I receive 4 emails with the exact same comment.

Perhaps there is a means you are able to remove me from that service?

Kudos!https://arzemjukazino.lv

when does cialis patent expire – ciltad genesis cialis for enlarged prostate

Honestly, I wasn’t expecting this, but it really caught my attention.

The way everything came together so naturally feels both surprising and refreshing.

Sometimes, you stumble across things without really searching, and it just clicks.

It reminds me of how little moments can have an unexpected impact

WOW just what I was searching for. Came here by searching for article source

1win hesab yaratmaq 1win hesab yaratmaq

tadalafil and sildenafil taken together – cialis online without pres tadalafil generico farmacias del ahorro

Don’t risk privacy breaches—our online phone number tool is perfect for one-time SMS verifications and secure platform testing.

Receiving SMS messages is an essential part of modern communication. SMS messages help us maintain connections with loved ones, colleagues, and associates.

With the rise of technology, SMS has turned into a key communication tool for numerous individuals. From reminders to updates, SMS serves a variety of purposes.

Nonetheless, certain individuals encounter difficulties when receiving SMS. Factors like connectivity issues, device settings, or technical malfunctions can lead to SMS delivery challenges.

To resolve these issues, users can check their network connection or phone settings. Regularly updating the software on the device can contribute to better SMS reception.

Добрый День,

Друзья.

Думаю я бы хотел рассказать больше про https://seniordigital.kz/psychkzcourse

Я думаю Вы заинтересованы именно про Онлайн курсы в Казахстане или возможно хотите найти больше про Онлайн курсы в Казахстане?!

Значит эта больше актуальная информация про Онлайн курсы в Казахстане будет для вас наиболее полезной.

На нашем веб портале Вы можете малость найти про Онлайн курсы в Ташкенте, также достоверно проверено информацию про Онлайн курсы в Узбекистане.

И, если Вы реально желаете иметь самую качественную информацию про ИТ услуги в Узбекистане – Мы готовы Вам ее дать.

Лучшие специалисты нашего Интернет сервиса на качественном уровне помогут Вам получить результативно то, что Вы долго искали в интернет.

Мы дадим вариант проверенной информации про Онлайн курсы в Казахстане.

Лучшие специалисты ждут Вас и готовы предоставить проверенный сервис. Спешите, действуют сезонные Ации на нашем веб сайте про Онлайн курсы в Ташкенте

Узнай Больше про https://seniordigital.kz/astanatradesd по ссылке https://seniordigital.kz/mobdevcoursesd

Наши Теги: ИТ услуги в Узбекистане, Онлайн курсы в Ташкенте, Онлайн курсы в Ташкенте, Онлайн курсы в Узбекистане, Онлайн курсы в Ташкенте, ИТ услуги в Казахстане, Онлайн курсы в Ташкенте;

Удачного Дня

Excellent article! We are linking to this great article on our site.

Keep up the great writing.

ranitidine us – https://aranitidine.com/# cheap ranitidine 150mg

Hey! I understand this is kind of off-topic however

I had to ask. Does building a well-established blog such as yours

take a massive amount work? I’m completely new to writing a

blog but I do write in my journal every day. I’d like to start a

blog so I can easily share my experience and feelings online.

Please let me know if you have any kind of recommendations or tips for new aspiring blog owners.

Thankyou!

Hello envoys of vitality !

Cat parents love using an air purifier for cat hair near litter boxes to eliminate smells and airborne litter dust. The air purifier for dog smell is most effective when placed near dog beds or play areas. Using the best air filter for pet hair also reduces the workload on your HVAC system over time.

The best home air purifier for pets can handle both small allergens and larger hair particles. It reduces the strain on heating and cooling systems. air purifier for dog hairHomes with pets tend to have cleaner air with these devices installed.

Air Purifier Pet Hair Removal Made Simple – https://www.youtube.com/watch?v=dPE254fvKgQ&list=PLslTdwhfiGf5uvrbVT90aiCj_6zWWGwZ3

May you enjoy remarkable filtered environments !

sildenafil 50 mg – strongvpls order viagra pills online

Ищете готовое решение? [url=https://karkasnye-doma0.ru/]Каркасный дом под ключ спб[/url] — практичный выбор для тех, кто ценит удобство и не хочет тратить время на отделочные работы.

Каркасный дом становится всё более популярным выбором для строительства жилья. Эти конструкции предлагают множество преимуществ, включая быстроту возведения и хорошую теплоизоляцию.

Одним из главных плюсов каркасного дома является его экономичность. Строительство такого дома позволяет значительно сократить затраты на материалы и рабочую силу.

Также каркасные дома могут быть легко настроены под любые климатические условия. С их помощью можно строить комфортное жильё для проживания в любых климатических зонах.

Тем не менее, каркасные дома не лишены недостатков, о которых стоит помнить. Одним из минусов каркасных домов является их меньшая пожарная безопасность по сравнению с традиционными кирпичными постройками. Эти факторы стоит учитывать, принимая решение о строительстве.

casino en 1 win 1win3048.com

Check out this link, this link, this link, this link, this link.

casino en 1 win [url=www.1win3045.com]casino en 1 win[/url]

For hottest information you have to pay a visit web and on internet I found

this web page as a finest web site for latest updates.

After the scab diminishes, you might observe small flaws in the skin. However, a person must exercise care, as tea tree oil can aggravate delicate skin. People might need to use the item numerous times before the growth falls away. According to the labeling on a few of these products, the skin tag should fall off within 2– 3 weeks.

An additional research links the human papillomavirus (HPV) to skin tag growth. Maternity and other hormonal adjustments might additionally contribute to the development of skin tags. Benign sores, like skin tags, typically need temperatures of − 13 ° F to − 58 ° F (− 25 ° C to − 50 ° C) to destroy them . Since over the counter cryotherapy products might not attain the cool temperature levels feasible with treatment from a skin doctor, they might not work for all skin tags. As with all skin developments, if you observe an adjustment in dimension or shade it’s a great concept to see a medical service provider.

While a lot of moles are benign, in many cases, a mole can be an indication of skin cancer cells, particularly melanoma. Freeze-away blemish cleaner is one more product people have actually tried to remove skin tags. The theory is that the cold produces a blister around the skin tag that makes it diminish. The trouble is that home excrescence items aren’t as cool as the liquid nitrogen your dermatologist uses to remove skin growths. ” The skin gets aggravated, however not inflamed sufficient for the development to diminish,” Hu states. Making use of a verruca cleaner can harm the skin, according to the AAD.

This therapy helps six months and is as a result not instantly noticeable. External beam of light radiation therapy needs multiple treatment sessions. Brachytherapy calls for surgery and anesthetic to insert the contaminated pellets on or near your tumor.

Specialists have great deals of experience developing mind sores with more intrusive approaches. This therapy is minimally intrusive, and it allows the healthy cells to prevent ending up being harmed throughout the therapy. HIFU offers trustworthy cancer cells destruction in the targeted location without radiation or incisions, and the therapy has actually limited negative effects, supplying low threat of urinary incontinence and erectile dysfunction. This treatment is an outpatient surgery treatment (2-4hours) with a brief recovery. Contrasted to MRgFUS, ultrasound imaging is easier and mechanically compatible, and offers the exact same form of power for image assistance as used for treatment.

‘ Finest Choice’ To Undergo Hifu

More frequent peeing with a seriousness to urinate.Urine leakage or urinary incontinence.Erectile dysfunction.Recurrence of cancer. Generally, HIFU gives a distinct method to fight the visible signs old without the threats and downtime related to surgeries. By harnessing the power of concentrated ultrasound, this cutting-edge innovation allows you to attain a much more younger, revitalized appearance from the within out. The amount of treatments will I need for HIFU Fat Reduction? We recommend three therapies every 4-weeks taking 12-weeks to get optimal outcomes.

A skin tag is a tiny piece of soft, fleshy, skin-colored tissue that sticks out from your skin, usually in locations where the skin rubs together, such as the neck or underarms. Skin tags and seborrheic keratoses look like we age. Sadly, this isn’t a concern you can attend to with a specialized skin care routine. ” There’s nothing you can truly do to avoid skin tags,” Dr. Evans says. If you have any one of the correlated wellness problems above, collaborating with your medical professional to obtain those controlled might additionally assist to prevent skin tags; though it’s not assured.

One reliable approach for eliminating small skin tags in your home is to link a slice of string around its base, then wait a couple of days for it to die. ” The concept is that you’re physically attempting to remove its blood supply, which after that allows it to shrivel up and diminish,” Massick states. Floss functions well due to the fact that it’s the right density. Skin tags do not require to be eliminated for health reasons, but they can be gotten rid of if they cause discomfort or for cosmetic reasons. Dermatologists might utilize techniques like reducing, cold, or cauterization for secure removal. Typically, skin tags are pain-free, yet they can come to be inflamed or capture on clothing, creating small pain.

The level to which urinary system continence or erectile feature are affected are primarily because of the amount of prostate dealt with and the place of the therapy area. A current study from the UK showed that 92% of guys kept urinary continence and 77% with regular erectile function prior to therapy preserved potency one year complying with a focal ablation. Aggressive or huge prostate cancers cells are best treated with surgical removal or radiation, however smaller or much less aggressive cancers are good prospects for treatment with HIFU. Some advantages of focal HIFU treatment consist of reduced rates of urinary system leak (incontinence), much better erectile feature results, and the capability to go home the very same day. An urinary catheter may still be needed for a couple days, however this is much less than the week usually called for by medical removal of the prostate. HIFU light beam can pass through overlapping skin and tissues without damage, and concentrate on a localized area with an upper dimension limitation of approximately 3– 4 cm in diameter for tumors.

Contribute Blood

This process produces thermal energy that tightens and gets the underlying tissues, reaching down to the shallow muscle aponeurotic system (SMAS)– a layer commonly altered only with medical methods. HIFU uses ultrasound waves to generate temperatures of 65C+, once they reach this temperature they experience cellular damages causing ‘thermal improvement’ that aids to raise and tighten up the skin. HIFU or High Strength Focused Ultrasound is the excellent treatment for body contouring, decreasing excess stomach fat, bingo wings, saddle bags, crepe skin etc. It’s an extremely efficient therapy for both inch loss and fat loss by completely ruining fat cells without harming the skin’s surface area. Not only does it remove fat it additionally tightens up loosened skin at the exact same time.

бк мелбет официальный сайт зеркало бк мелбет официальный сайт зеркало

Thanks recompense sharing. It’s outstrip quality. https://buyfastonl.com/gabapentin.html

Just wish to say your article is as amazing.

The clarity in your post is simply spectacular and i could assume you’re an expert on this

subject. Well with your permission allow me to grab your feed to

keep up to date with forthcoming post. Thanks a million and please carry

on the rewarding work.

More posts like this would make the blogosphere more useful. https://gnolvade.com/

magnificent points altogether, you just gained a new reader.

What may you recommend about your post that you simply made some

days in the past? Any positive?

Мы предлагаем типовые и индивидуальные деревянный дом под ключ проекты и цены, которые можно адаптировать под ваши цели и участок.

Деревянные дома под ключ становятся все более популярными среди владельцев загородной недвижимости. Эти сооружения привлекают своим природным очарованием и экологичностью.

Главное преимущество деревянных домов заключается в быстроте их строительства. С помощью современных технологий можно построить такие здания в минимальные сроки.

Деревянные дома славятся хорошей теплоизоляцией. Зимой в них тепло, а летом они остаются прохладными.

Обслуживание деревянных домов не вызывает особых трудностей и не требует значительных усилий. Периодическая обработка древесины защитными составами значительно увеличивает долговечность дома.

Hey there! Do you know if they make any plugins to help with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you!

I think that is one of the such a lot significant info for me.

And i’m happy studying your article. But should

statement on some general issues, The website taste is perfect,

the articles is actually nice : D. Just right process, cheers

скачать мелбет зеркало https://melbet3004.com

¿Hola seguidores del juego ?

Los lГmites de tiempo para retiros suelen ser mucho mГЎs flexibles y rГЎpidos que en operadores nacionales.apuestas fuera de espaГ±aEsto mejora la experiencia del usuario.

Las apuestas fuera de EspaГ±a permiten participar en desafГos comunitarios para ganar logros y premios. Puedes competir en ligas semanales con otros jugadores. Y mejorar tu posiciГіn con cada acierto.

Apuestas fuera de espaГ±a: guГas para apostar sin riesgos – https://casasdeapuestasfueradeespana.guru/#

¡Que disfrutes de enormes logros !

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Excellent goods from you, man. I’ve be mindful your stuff prior to and you are just extremely magnificent.

I actually like what you’ve acquired right here, certainly like what you are saying and

the best way during which you assert it. You’re making it enjoyable

and you continue to take care of to keep it sensible. I can not wait to learn far more from you.

That is actually a terrific web site.

I’ve learn some good stuff here. Definitely worth bookmarking for revisiting.

I wonder how so much attempt you set to create one of these fantastic informative website.

Если вы ищете комфортное и практичное жилье, каркасный дом в спб станет отличным решением. Предлагаем прозрачные цены, надежность и индивидуальный подход.

Каркасный дом — это один из самых популярных типов жилья в современном строительстве. Эти здания имеют целый ряд плюсов, например, скорость возведения и хорошую изоляцию от холода.

При строительстве каркасного дома важно учитывать качество используемых материалов. Важным аспектом являются утеплитель и внешняя отделка, на которых не стоит экономить.

Важно учитывать проект и габариты при выборе каркасного дома. Грамотное планирование поможет сделать пространство максимально удобным и функциональным.

В итоге, каркасный дом может стать идеальным вариантом для вашего будущего жилья. Кроме того, его строительство не требует значительных временных затрат и финансовых вложений.

Новый формат летнего отдыха — покататься на яхте в сочи. Это сочетание уюта, эстетики и живописных видов, недоступных с берега.

Сочи – идеальное место для морских прогулок, наполненных яркими эмоциями. Каждый год тысячи туристов выбирают этот курорт для создания незабываемых воспоминаний.

Сочи изобилует предложениями по организации запоминающихся морских прогулок. Гости курорта могут наслаждаться как короткими, так и длительными прогулками вдоль живописного побережья.

Морские прогулки открывают захватывающие виды на волны и окружающие горы. Некоторые экскурсии предлагают шанс увидеть дельфинов и других животных в их естественной среде обитания.

Не упустите шанс сделать фотографии, которые будут напоминать о вашем путешествии. Прогулки на море – замечательный способ провести время с близкими.

This is the kind of serenity I get high on reading. https://ursxdol.com/synthroid-available-online/

Hola! I’ve been following your blog for a while

now and finally got the bravery to go ahead and give you a shout out from Huffman Texas!

Just wanted to mention keep up the great work!

I feel that is among the such a lot important info for

me. And i’m satisfied reading your article. But want to observation on few general issues, The web site style is great, the articles is truly excellent :

D. Excellent activity, cheers

More posts like this would make the blogosphere more useful. https://prohnrg.com/product/omeprazole-20-mg/

Hello there! This is kind of off topic but I need some

help from an established blog. Is it difficult to

set up your own blog? I’m not very techincal but I can figure things out pretty quick.

I’m thinking about setting up my own but I’m not sure where to begin. Do you have any ideas or suggestions?

Cheers

My brother suggested I might like this blog. He was entirely right.

This post truly made my day. You cann’t imagine simply how much time I had spent

for this info! Thanks!

Официальный канал Live-казино: рейтинги проверенных площадок, актуальные зеркала и бонусы. Разбираем стратегии для рулетки, блэкджека и игровых шоу. Эксклюзивные промокоды для максимального старта. Регистрируйся, играй и выводи выигрыши!

https://t.me/s/iGaming_live/1050

Official Live Casino Channel

Verified platforms rating? Working mirrors updated hourly Mega bonuses +300%! Winning strategies for roulette, poker and Sweet Bonanza. EXCLUSIVE PROMOCODES. Sign up, play & withdraw instantly!

Выбери свою игру:

https://t.me/s/iGaming_live/190

https://t.me/s/iGaming_live/2080

Заказывая [url=https://genuborka11.ru/]генеральная уборка квартиры цена[/url], вы получаете прозрачную смету без скрытых расходов. Все услуги заранее согласовываются и выполняются точно в срок.

Генеральная уборка — это существенное событие для в жизни любой семьи. Эта процедура позволяет поддерживать порядок и комфорт в доме.

Эффективная уборка начинается с четкого плана. Сначала определите, какие помещения требуют внимания. Такой подход позволит избежать хаоса.

Кроме того, важно подготовить необходимые средства. К числу основных принадлежностей относятся чистящие средства, тряпки и пылесос. Приятно и быстро работать, когда все под рукой.

После того, как все подготовлено, стоит приступать к уборке. Работайте поочередно в каждой комнате. Так будет легче увидеть результаты своих трудов.

It’s actually a great and helpful piece of info. I am glad that you just shared

this useful information with us. Please keep us

up to date like this. Thank you for sharing.

1win armenia 1win armenia

как пополнить 1win [url=www.1win3070.ru]как пополнить 1win[/url]

Pinco az ilə oynamaq çox rahatdır.

Kazino seçərkən pinco casino azerbaijan ən yaxşı seçimdir pinco gazino .

Pinco casino istifadəçilər üçün müxtəlif oyun imkanları təqdim edir.

Pinco azerbaycan yükle və dərhal başla.

Pinco casino mobil tətbiqi çox funksionaldır.

Pinco kazinosunda hər zövqə uyğun oyun var.

Pinco casino az müştəri dəstəyi çox operativdir.

Pinco bet mobil versiyası çox funksionaldır.

Pinco oyunu ilə vaxtı əyləncəyə çevir pinco com.

мостбет [url=https://mostbet4083.ru/]мостбет[/url]

id=”firstHeading” class=”firstHeading mw-first-heading”>Search results

Help

English

Tools

Tools

move to sidebar hide

Actions

General

зайти в мостбет https://mostbet4082.ru/

1win պաշտոնական https://www.1win3075.ru

This is the tolerant of delivery I recoup helpful. https://aranitidine.com/fr/cialis-super-active/

Do you have any video of that? I’d care to find out some

additional information.

988bet

I am in fact delighted to glance at this blog posts which contains

lots of useful facts, thanks for providing these kinds

of statistics.

Hi! I just wish to give you a big thumbs up for the excellent info you’ve got right here on this post.

I am returning to your web site for more soon.

Только у нас:

– Рейтинг ТОП-5 надежных live-казино

– Зеркала, работающие прямо сейчас

– Фриспины и кэшбэк 15%

– Пошаговые стратегии для рулетки и блэкджека

РЕГИСТРИРУЙСЯ ПО ПРОМОКОДУ > Играй > Выводи крипту!

Выбери свою игру: https://t.me/iGaming_live

Live Casino Telegram

Live Casino – канал о лицензионных казино

Live Casino – лучший канал о казино в Telegram

Live Casino – канал о лицензионных казино

Канал о ставках и казино в Telegram

Paragraph writing is also a excitement, if you be familiar with afterward you can write otherwise it

is complicated to write.

mostbet mostbet

I like the helpful info you provide in your articles. I’ll bookmark your

weblog and check again here frequently. I am quite sure I’ll learn many new

stuff right here! Good luck for the next!

Really nice writing. Thanks for sharing. If anyone’s looking to start, daftar KEY4D is quick and easy.

Great write-up. I’m checking this blog regularly and I am impressed! Check out BINGO4D for the most exciting games online.

Everyone loves it when people come together

and share ideas. Great site, keep it up!

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is fundamental and all.

But just imagine if you added some great visuals or video clips to give

your posts more, “pop”! Your content is excellent but with pics and

clips, this site could definitely be one of the best in its niche.

Awesome blog!

melbet sportsbook [url=https://melbet1031.ru]https://melbet1031.ru[/url]

Готовый деревянный коттедж под ключ может стать идеальным местом для отдыха или постоянного проживания за городом в тишине и комфорте.

В последнее время деревянные дома под ключ привлекают внимание людей, стремящихся к уютному загородному отдыху. Эти сооружения привлекают своим природным очарованием и экологичностью.

Главное преимущество деревянных домов заключается в быстроте их строительства. Использование современных методов строительства позволяет быстро возводить такие дома.

Деревянные дома также отличаются высокой теплоизоляцией. Зимой в таких домах комфортно и тепло, а летом всегда свежо и прохладно.

Уход за деревянными домами довольно прост и не требует больших усилий. Частая обработка дерева специальными средствами способствует увеличению срока службы конструкции.

¿Hola competidores del azar?

For those who prefer simplicity, the 1xbet registration in nigeria option is the most convenient. 1xbet nigeria registration online No email or complex forms are required. Just input your phone number and confirm via SMS.

The platform’s 1xbet ng login registration online ensures everything stays synced across devices. You can log in from phone, laptop, or tablet. The process remains the same.

How to do 1xbet ng login registration securely – https://www.1xbetnigeriaregistrationonline.com/

¡Que disfrutes de enormes ventajas !

Kazino pinco ilə qazanmaq daha asandır. Əyləncə və gəlir bir arada – pinco onlayn kazino pinco game . Pinco giris problemsiz və sürətli işləyir. Pinco casino mobile hər yerdə əlinizin altındadır. Pinco azerbaycan yukle – birbaşa telefona yüklə və oynamağa başla. Pinco casino скачать Android və iOS üçün mövcuddur. Pinco kazino istifadəçilər üçün rahat interfeys təqdim edir. Pinco casino azerbaijan-da ödənişlər vaxtında həyata keçirilir. Pinco casino giriş çox sadə və sürətlidir pinco casino indir.

Обеспечьте чистоту в помещении с минимальными затратами времени. Оптимальный выбор — [url=https://kliningovaya-kompaniya-v-spb-01.ru/]клининг в питере[/url], выполненный профессиональной командой.

Профессиональные очистительные услуги в Санкт-Петербурге – это важная услуга для множества людей и организаций. Поддержание чистоты – это важный аспект в рабочей среде. Существуют профессиональные компании, предоставляющие услуги клининга.

Определение нужд в клининге – первый шаг к чистоте. Например, нужны ли вам услуги по уборке квартир или офисов. Также важно учитывать частоту уборки.

Следующий шаг – выбрать надежную клининговую фирму. Изучите отзывы о клининговых услугах, чтобы сделать правильный выбор. Проверенные клининговые организации обязательно дадут гарантии на результат.

Наконец, прежде чем сделать выбор, обязательно сравните цены. Разные компании могут предлагать различные расценки на свои услуги. Помните, что высокая стоимость не всегда является показателем превосходства.

Greetings to all thrill gamblers !

Nigerian players can easily sign up through 1xbet nigeria login registration using only their mobile numbers. The process supports biometric verification for added security. 1xbet nigeria registration 1xbet nigeria login registration ensures rapid access to the betting dashboard.

For a smooth and intuitive experience, try the 1xbet nigeria registration online portal. It provides tutorials specifically designed for Nigerian users. The 1xbet nigeria registration online platform supports real-time balance updates.

Login securely with 1xbet ng login registration – http://www.1xbetregistrationinnigeria.com

Hope you enjoy amazing big wins!

Azərbaycanda ən yaxşı pinco casino xidmətləri buradadır. Pinco bet idman mərcləri üçün də uyğundur казино pinco . Pinco qeydiyyat üçün heç bir çətinlik yoxdur. Pinco casino mobil versiyası çox sürətlidir. Pinco yukle və oyuna qoşul. Pinco bonusları yeni istifadəçilər üçün cazibəlidir. Pinco bet ilə canlı mərc etmək imkanı var. Pinco oyun platforması rahat və sadə dizayna malikdir. Pinco apk indir sürətli və təhlükəsizdir pinco-kazino.website.yandexcloud.net.

Hey there, all betting experts !

1xbet nigeria registration online caters specifically to Nigerian punters. The platform offers local games and sports events. 1xbet nigeria login registration Bonuses are tailored for the local market.

Go to 1xbetloginregistrationnigeria.com to register within seconds. This site is optimized for Nigerian devices and internet speeds. You’ll find detailed instructions for every step.

Guide to 1xbet registration by phone number nigeria with bonus – http://1xbetloginregistrationnigeria.com/

Savor exciting payouts !

Pinco yukle etdikdən sonra oyundan zövq alırsız. Pinco azerbaycan versiyası lokal müştərilər üçün əladır pinco online casino . Pinco giris etdikdən sonra xoş bonus alırsız. Pinco app rahat və istifadəsi asandır. Pinco qeydiyyat zamanı bonus təqdim edir. Pinco app ilə oyun tam mobil uyğunluqla təqdim olunur. Pinco qeydiyyat zamanı çətinliklə qarşılaşmadım. Pinco oyun platforması rahat və sadə dizayna malikdir. Pinco yukle üçün rəsmi səhifədən istifadə edin [url=https://pinco-kazino.website.yandexcloud.net/]pinco bet[/url].

No matter if some one searches for his essential thing, therefore he/she wants to

be available that in detail, therefore that thing is maintained over here.

Salutations to all thrill hunters !

Start your journey with 1xbet nigeria registration and explore live betting options. Register now to enjoy exclusive offers tailored for Nigerian users. 1xbet nigeria login registration The process of 1xbet nigeria registration is fast, safe, and user-friendly.

You can easily reset your password through 1xbet nigeria login registration if needed. Help is always available. That’s why people feel secure with 1xbet nigeria login registration.

Complete 1xbet ng login registration online fast – https://www.1xbetnigeriaregistration.com.ng/

Wishing you thrilling treasures !

кашпо для цветов дизайнерские [url=https://dizaynerskie-kashpo-sochi.ru/]кашпо для цветов дизайнерские[/url] .

If some one needs expert view concerning running a

blog after that i recommend him/her to pay a quick visit this

website, Keep up the pleasant work.

Pinco giriş bağlantısı həmişə yenilənir. Pinco azerbaycan versiyası lokal müştərilər üçün əladır pinco casino azerbaijan . Pinco kazinosu oyunçular üçün əlverişli şərait yaradır. Pinco giris üçün hər zaman aktual link var. Pinco kazino ilə oyun daha maraqlı olur. Pinco giris hər zaman mövcuddur və işləkdir. Pinco oyunları real vaxtda və yüksək sürətlə təqdim olunur. Pinco apk ilə istənilən yerdə oyna. Pinco bet ilə istənilən idman növünə mərc et pinco kazinosu.

I always spent my half an hour to read this website’s articles all the time along with a mug

of coffee.

мостбет регистрация узбекистан [url=http://mostbet4080.ru/]мостбет регистрация узбекистан[/url]

Warm greetings to all fortune players !

Want to get started instantly? Visit https://www.1xbet-nigeria-registration-online.com/ and register with your preferred method. The 1xbet ng login registration online page supports multiple languages and payment methods.

Players interested in fast registration should visit https://1xbet-nigeria-registration-online.com/. There’s no need for paperwork or delays. The 1xbet Nigeria registration online portal makes the whole process smooth and efficient.

Complete your 1xbet Nigeria registration online in minutes – http://www.1xbet-nigeria-registration-online.com

Hoping you hit amazing rounds !

1win oynalgan sayt uz https://1win3065.ru

More posts like this would create the online play more useful. https://ondactone.com/spironolactone/

Wonderful website. A lot of useful info here. I am sending it to several friends ans additionally sharing in delicious.

And obviously, thank you for your effort!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

купить кашпо дизайнерские купить кашпо дизайнерские .

Не тратьте лишние силы на уборку — в этом поможет [url=https://kliningovaya-kompaniya-1.ru/]служба клининга в Москве[/url], работающая как с частными, так и с корпоративными клиентами.

Клининг в Москве — это услуга, которая становится все более популярной среди жителей столицы. Современный ритм жизни в Москве подталкивает людей выбирать услуги клининга для поддержания порядка.

В Москве существует множество клининговых агентств, которые предоставляют разнообразные услуги, от уборки квартир до чистки ковров. Каждая клининговая компания в Москве старается привлечь клиентов уникальными предложениями и высокими стандартами качества.

Высококачественный клининг требует использования профессионального оборудования и чистящих средств. Специалисты клининговых компаний проходят обучение, что позволяет им успешно справляться с любыми задачами по уборке.

Цены на услуги клининга в Москве могут различаться в зависимости от сложности и объема выполняемой работы. Прежде чем принимать решение, стоит ознакомиться с отзывами о различных клининговых компаниях и оценить их предложения.

клининг компания [url=https://kliningovaya-kompaniya-1.ru/]клининг компания[/url] .

интересные кашпо для цветов интересные кашпо для цветов .

https://livecage.com.ua/ru/2025/07/vinetka-v-slovakii-chto-jeto-i-zachem-nuzhna/

Kind regards to all gaming admirers !

A hassle-free 1xbet ng registration ensures you can focus on what matters most: finding winning bets. The platform’s design philosophy is centered on removing distractions and streamlining the betting process. [url=http://www.1xbet-login-nigeria.com/]1xbet-login-nigeria.com[/url] Enjoy a clean and efficient user interface.

Using the official link https://www.1xbet-login-nigeria.com/ ensures that you are eligible for all regional promotions and bonuses. Some offers are specific to players from Nigeria, and using the correct portal guarantees you won’t miss out. Maximize your rewards by using the official site.

1xbet ng login registration | NG Official Site – https://www.1xbet-login-nigeria.com/

Wishing you incredible cash prizes !

Hello everyone, all reward hunters !

Accessing the 1xbet ng login registration online form takes less than a minute and requires only a valid phone number or email. Once completed, your 1xbet nigeria registration online account will be active instantly. [url=https://www.1xbet-ng-registration.com.ng/#]1xbet registration nigeria[/url] The official portal at 1xbet-ng-registration.com.ng offers full support for new sign-ups.

You can complete your 1xbet nigeria login registration from any device, whether it’s your phone or computer. Registration is quick, and the platform supports local banks for fast transactions. Once signed up, you’re ready to explore top leagues and casino games.

Full steps for 1xbet registration nigeria users – http://www.1xbet-ng-registration.com.ng/

Enjoy thrilling rounds !

melbet букмекерская контора скачать на телефон [url=melbet1040.ru]melbet букмекерская контора скачать на телефон[/url]

This website really has all of the low-down and facts I needed adjacent to this case and didn’t know who to ask.

levaquin brand

jocuri poker http://1win40010.ru

большие дизайнерские кашпо https://www.dizaynerskie-kashpo-rnd.ru .

завантажити 1він http://1win40008.ru

Đến với trang ấu dâm – mại dâm, bạn không chỉ được xem full hd siêu mượt mà còn được chat sex cực vui.

¡Buenas!

como jugar casino en linea con dinero real bolivia

Lee este enlace – https://casinogamesonline.cfd/

como jugar casino en linea con dinero real bolivia

casino en lГnea dinero real bolivia

casino con dinero real bolivia

¡Buena suerte!

¡Saludos a todos los visitantes del casino !

Casasdeapuestassindni ofrece plataformas rГЎpidas y seguras. Casa de apuestas sin dni elimina esperas innecesarias. casas de apuestas sin dni Casas de apuestas SIN registro dni permiten jugar de forma inmediata.

Casasdeapuestassindni.guru ofrece acceso a plataformas anГіnimas. Apuestas deportivas sin dni estГЎn disponibles sin registro. Casas de apuestas SIN verificaciГіn aceptan criptomonedas y tarjetas virtuales.

Explora casasdeapuestassindni.guru sin riesgo – http://casasdeapuestassindni.guru/#

¡Que goces de increíbles partidas !

http://www.elinewberger.com là website lừa đảo chính hiệu tập hợp ổ tội phạm nguy hiểm hàng đầu, không chỉ chiếm đoạt tiền bạc, đánh cắp thông tin cá nhân mà còn liên quan đến buôn bán người và các hoạt động phạm pháp nghiêm trọng khác. Mọi tương tác với trang này đều đặt bạn vào nguy cơ cực lớn. Tuyệt đối tránh xa, cảnh báo người thân và báo ngay cơ quan chức năng để xử lý kịp thời.

Nơi quy tụ những pha “gáy sớm” huyền thoại và những chất kích thích chất lượng cao. Vào là dính, xem là mê, chơi là cực cháy. Hóng bóng cười mà không ghé nơi mua bánMa túy giao hàng nhanh là thiếu muối đấy!

стильные горшки для цветов стильные горшки для цветов .

Здравствуй!

Онлайн казино Казахстана соответствует стандартам. казахстан онлайн казино Безопасность игроков на первом месте.

По ссылке: – https://mobilecasinogames.cfd/

vavada казино онлайн казахстан вход

онлайн казино кз

онлайн казино в казахстане

Пока!

¡Bienvenido!

Un casino real en lГnea brinda emociГіn autГ©ntica. casino en lГnea dinero real Vive la experiencia Las Vegas.

Lee este enlace – https://smartphonecasino.cfd

juego casino real

casino en lГnea dinero real

casino online dinero real mГ©xico

¡Buena suerte!

Привет,

Дорогие Друзья.

Сейчас я бы хотел поведать больше про https://sukoyaka-labo.com/

Я думаю Вы думаете именно про vavada официальный регистрация или возможно желаете поведать больше про казино вавада играть онлайн?!

Значит эта больше актуальная информация про бонусы на вавада будет для вас наиболее полезной.

На нашем сайте больше больше про вавада зеркало официальный сайт, также информацию про vavada casino promo code.

Узнай Больше про https://sukoyaka-labo.com/ по ссылке https://sukoyaka-labo.com/

Наши Теги: Vavada игровые автоматы, vavada промокод на сегодня, промокод для вавада 2024, как активировать промокод в казино vavada, вавада рабочее зеркало на сегодня, vavada casino бонус код, вавада казино играть онлайн зеркало, официальный сайт vavada casino, вавада официальный сайт вход, вавада как отыграть бонус, не могу войти на сайт вавада, вавада казино онлайн бесплатно,

Удачного Дня

Good afternoon,

Dear Friends.

Now I would like to tell a little about https://tradfibrocfa.com/

I think you in search of specifically about hyperliquid onchain trading or perhaps you want to tell more about fast onchain trading?!

So this most up-to-date information about layer 1 trading platform will be the most useful for you.

On our site more more about layer 1 trading platform, also information about hyperliquid + tradfibrocfa.

Find out more about https://tradfibrocfa.com/ at https://tradfibrocfa.com/

Our Tags: Liquid orderbook defi, hyperliquid crypto trading, hyperliquid x tradfibrocfa,

Have a good day

стильные горшки https://dizaynerskie-kashpo-nsk.ru .

¡Un cordial saludo a todos los fanáticos del azar !

Los los mejores casinos online ofrecen una experiencia de juego segura y variada. Muchos jugadores prefieren casinosonlineeuropeos por sus bonos atractivos y soporte en varios idiomas. casinos online europeos Un mejores casinos garantiza retiros rГЎpidos y mГ©todos de pago confiables.

Los casinos online europeos ofrecen una experiencia de juego segura y variada. Muchos jugadores prefieren casinosonlineeuropeos por sus bonos atractivos y soporte en varios idiomas. Un casino europeo garantiza retiros rГЎpidos y mГ©todos de pago confiables.

Casinos europeos con pagos rГЎpidos y sin lГmites – https://casinosonlineeuropeos.xyz/#

¡Que goces de increíbles premios !

Chúng tôi chuyên buôn bán nội tạng trẻ em còn tươi. Giá cả thương lượng. Buôn bán nội tạng hỗ trợ cấy ghép tạng. Hàng tươi nên các bác vui lòng giao dịch bằng tiền mặt. Nội tạng được mổ sống từ người khỏe mạnh, không gây tê nên không nhiễm bệnh. Bao trả hàng.

После завершения ремонта вам потребуется уборка после ремонта клининговой компанией, чтобы вернуть дому чистоту и порядок.

Уборка после ремонта — важный этап, который часто игнорируется. Комплексная уборка позволит не только убрать строительный мусор, но и обеспечить уют в обновленном пространстве.

Первым делом стоит удалить крупный мусор, который остается после всех работ. Затем следует провести более детальную уборку, которая включает в себя вытирание пыли с поверхностей и мытье полов.

Обязательно проверьте труднодоступные участки, которые могут быть полны пыли. Часто такие места остаются незамеченными и могут стать источником неприятных запахов.

Когда уборка окончена, нужно подумать о добавлении приятных ароматов в пространство. Эфирные масла или ароматические свечи сделают атмосферу более уютной.

кашпо с автополивом цена https://kashpo-s-avtopolivom-kazan.ru/ .

¡Mis mejores deseos a todos los conquistadores de la fortuna !

Explorando casinosonlineinternacionales obtienes mesas en vivo con crupieres reales y soporte dedicado en espaГ±ol. [url=п»їhttps://casinosonlineinternacionales.guru/]casino online internacional[/url] Los sitios modernos aseguran verificaciГіn ligera y rГЎpida y seguridad reforzada con cifrado. Con ello la curva de aprendizaje es corta y efectiva.

Explorando casinos internacionales encaras con giros gratis frecuentes y soporte dedicado en espaГ±ol. Las casas globales habilitan atenciГіn al cliente 24/7 y mesas exclusivas para VIP. Con ello accedes a valor real y condiciones limpias.

Casinos online internacionales con giros gratis – http://casinosonlineinternacionales.guru/#

¡Que disfrutes de extraordinarias beneficios !

?Mis calidos augurios para todos los virtuosos de las apuestas !

Los casinos europeos online actualizan sus promociones con frecuencia. [url=п»їhttps://casinoonlineeuropeo.blogspot.com/][/url] Los casinos europeos priorizan la seguridad del usuario. Un euro casino online combina diversiГіn y seguridad.

Los casinos europeos online actualizan sus promociones con frecuencia. Los casinos europeos online transmiten juegos en vivo en alta definiciГіn. Los mejores casinos online ofrecen jackpots progresivos.

La verdad sobre un euro casino online – п»їhttps://casinoonlineeuropeo.blogspot.com/

?Que goces de excepcionales botes!

casinoonlineeuropeo.blogspot.com

[url=https://auto.rin.ru/novosti/228893/vash-phuket-za-rulem-svoboda-ekonomiya-i-nezabivaemie-vpechatleniya.html]прокат авто пхукет[/url]

Аренда автомобилей на Пхукете — идеальное решение для путешественников. Это позволит вам удобно перемещаться по всем живописным местам.

В Пхукете есть разнообразные компании, которые занимаются арендой автомобилей. Вы можете выбрать из множества автомобилей разных марок и классов.

Не забывайте внимательно изучать условия аренды автомобиля. Проверьте, включена ли страховка в стоимость аренды.

Также стоит помнить о правилах дорожного движения в Таиланде. Имейте в виду, что в стране левостороннее движение, и это может вызвать некоторые трудности.

дизайнерские кашпо для цветов напольные http://dizaynerskie-kashpo-rnd.ru/ .

With thanks. Loads of conception! http://sglpw.cn/home.php?mod=space&uid=563599

5679 là điểm đến lý tưởng cho những ai đam mê cá cược và giải trí trực tuyến. Nổi bật với kho game phong phú từ thể thao,

casino, slot game cho đến xổ số, 5679 đáp ứng mọi

nhu cầu giải trí của người chơi. Hệ thống được

đầu tư bài bản với công nghệ hiện đại, tốc độ nạp rút nhanh chóng và bảo mật tuyệt đối.

Cùng với đó, 5679 luôn dành nhiều khuyến mãi giá

trị và dịch vụ hỗ trợ khách

hàng 24/7, mang đến trải nghiệm an toàn và chuyên nghiệp.

Thông tin liên hệ :

Thương Hiệu : 5679

Địa Chỉ : 46 Nguyễn Duy Cung, Phường 12, Gò Vấp,

Hồ Chí Minh, Việt Nam

SĐT : 0928745139

Website : https://x5679.net/

Email : x5689net@gmail.com

Hashtags : #5679, #nhacai_5679, #link_5679, #trangchu_5679, #dangnhap_5679, #khuyenmai_5679

https://www.facebook.com/x5679net/

https://x.com/x5689net

https://www.youtube.com/@x5679net/about

https://www.pinterest.com/x5679net/_profile/

https://www.tumblr.com/settings/blog/x5679net

https://www.reddit.com/user/x5689net/

https://www.instapaper.com/p/x5679net

https://www.twitch.tv/x5689net/about

https://www.blogger.com/profile/03757291341507094670

https://disqus.com/by/x5679net/about/

https://os.mbed.com/users/x5689net/

https://qiita.com/x5679net

https://gravatar.com/x5679net

https://github.com/x5689net

https://issuu.com/x5689net

https://profile.hatena.ne.jp/x5689net/profile

https://pubhtml5.com/homepage/ervja/

https://gitlab.com/x5679net

https://www.speedrun.com/users/x5679net

https://www.renderosity.com/users/id:1765425

https://stocktwits.com/x5679net

https://old.bitchute.com/channel/yDv6lvkSXaoG/

https://heylink.me/x5689net/

https://500px.com/p/x5689net

https://www.callupcontact.com/b/businessprofile/x5689net/9765964

https://scrapbox.io/x5689net/x5689net

https://undrtone.com/x5689net

https://dreevoo.com/profile_info.php?pid=852156

http://www.aunetads.com/view/item-2720547-x5689net.html

https://transfur.com/Users/x5689net

https://easymeals.qodeinteractive.com/forums/users/x5689net/

https://huggingface.co/x5679net

https://writeablog.net/1pkj9pc8wl

https://www.metooo.io/u/x5689net

https://x5689net.symbaloo.com/home/mix/13eOhPIBXi

https://www.reverbnation.com/artist/x5679net

https://www.threadless.com/@x5689net/activity

https://tap.bio/@x5689net

https://wallhaven.cc/user/x5689net

https://securityheaders.com/?q=https%3A%2F%2Fx5679.net%2F&followRedirects=on

https://velog.io/@x5689net/about

https://blogfreely.net/x5689net/x5689net

https://www.iconfinder.com/user/x5679net

https://www.hulkshare.com/x5689net

https://decidim.derechoaljuego.digital/profiles/x5679net/activity

https://engage.eiturbanmobility.eu/profiles/x5679net/activity

https://masculinitats.decidim.barcelona/profiles/x5679net/activity

https://forum.skullgirlsmobile.com/members/x5689net.130137/about

https://secondstreet.ru/profile/x5689net/

https://menta.work/user/199428

https://band.us/band/99661906/post/1

https://wakelet.com/@x5679net

https://link.space/@x5689net

https://gifyu.com/x5679net

http://forum.446.s1.nabble.com/5679-Trang-ng-Nh-p-Nha-Cai-5679-M-i-Nh-t-td78683.html

https://code.antopie.org/x5679net

https://gitlab.vuhdo.io/x5679net

https://app.talkshoe.com/user/x5689net

https://wefunder.com/x5689net

https://edabit.com/user/aFHfRQ2SMZm7L7Ac3

https://topsitenet.com/profile/x5689net/1452663/

https://www.dermandar.com/user/x5689net/

https://slidehtml5.com/homepage/fvtm#About

https://www.magcloud.com/user/x5689net

https://nhattao.com/members/user6813562.6813562/

http://fort-raevskiy.ru/community/profile/x5679net/

https://aprenderfotografia.online/usuarios/x5689net/profile/

https://phatwalletforums.com/user/x5679net

https://about.me/x5689net/

https://www.multichain.com/qa/user/x5679net

https://roomstyler.com/users/x5679net

https://www.myminifactory.com/users/x5679net

https://coub.com/x5689net

https://community.fabric.microsoft.com/t5/user/viewprofilepage/user-id/1336714

https://doodleordie.com/profile/x5689net

https://www.mapleprimes.com/users/x5679net

https://pxhere.com/en/photographer/4726954

https://www.divephotoguide.com/user/x5689net

https://www.producthunt.com/@x5689net

https://hub.docker.com/u/x5689net

https://justpaste.it/u/x5679net

https://www.heavyironjobs.com/profiles/7049077-nha-cai-5679

https://app.scholasticahq.com/scholars/458921-nha-cai-5679

https://mavenshowcase.com/profile/58916320-4081-70e9-a413-6904b6597025

https://pumpyoursound.com/u/user/1520151

http://forum.modulebazaar.com/forums/user/x5689net/

https://www.checkli.com/x5679net

https://participons.mauges-sur-loire.fr/profiles/x5679net/activity

http://jobs.emiogp.com/author/x5689net/

https://blender.community/x5679net/

https://marketplace.trinidadweddings.com/author/x5689net/

https://activepages.com.au/profile/x5679net

https://biolinky.co/x-5689-net

https://myanimeshelf.com/profile/x5679net

https://jobs.suncommunitynews.com/profiles/7049226-nha-cai-5679

https://pads.zapf.in/s/fymHrFv7o

https://jobs.landscapeindustrycareers.org/profiles/7049239-nha-cai-5679

http://dtan.thaiembassy.de/uncategorized/2562/?mingleforumaction=profile&id=370342

https://protospielsouth.com/user/78384

https://www.malikmobile.com/x5679net

https://www.golden-forum.com/memberlist.php?mode=viewprofile&u=196729

https://fliphtml5.com/homepage/x5689net/x5679net/

https://community.m5stack.com/user/x5689net

https://allmyfaves.com/x5679net

https://www.iniuria.us/forum/member.php?592106-x5689net

https://jobs.westerncity.com/profiles/7048888-nha-cai-5679

https://jobs.njota.org/profiles/7048889-nha-cai-5679

https://www.nintendo-master.com/profil/x5689net

https://chillspot1.com/user/x5689net

https://ioninja.com/forum/user/x5689net

https://files.fm/x5689net/info

https://leetcode.com/u/x5679net/

http://qooh.me/x5679net

https://www.walkscore.com/people/623280368910/x5679net

https://findaspring.org/members/x5689net/

https://safechat.com/u/x5689net

https://phijkchu.com/a/x5689net/video-channels

https://photoclub.canadiangeographic.ca/profile/21690392

https://forum.issabel.org/u/x5689net

https://cadillacsociety.com/users/x5689net/

https://bulios.com/@x5679net

https://anyflip.com/homepage/xzpgs

https://wirtube.de/a/x5689net/video-channels

https://savelist.co/profile/users/x5679net

https://www.aicrowd.com/participants/x5679net

https://www.rctech.net/forum/members/x5689net-496831.html

https://www.huntingnet.com/forum/members/x5689net.html

https://tooter.in/x5689net

https://forum.lexulous.com/user/x5689net

http://freestyler.ws/user/571745/x5679net

http://www.ssnote.net/users/x5689net

https://www.skool.com/@nh-cai-3091

https://www.giveawayoftheday.com/forums/profile/1124012

https://eo-college.org/members/x5689net/

https://www.dotafire.com/profile/x5689net-194303?profilepage

https://hanson.net/users/x5689net

https://we-xpats.com/vi/member/60842/

https://schoolido.lu/user/x5689net/

https://kaeuchi.jp/forums/users/x5689net/

https://theafricavoice.com/profile/x5679net

https://routinehub.co/user/x5679net

https://ficwad.com/a/x5679net

http://www.fanart-central.net/user/x5679net/profile

https://www.directorylib.com/domain/x5679.net

https://maxforlive.com/profile/user/x5679net?tab=about

https://1businessworld.com/pro/x5679net/

https://liulo.fm/x5679net

https://www.pozible.com/profile/x5679net

https://advego.com/profile/x5679net/

https://www.wvhired.com/profiles/7049978-nha-cai-5679

https://www.nicovideo.jp/user/141296228

https://slatestarcodex.com/author/x5679net/

https://linkstack.lgbt/@x5679net

https://participa.terrassa.cat/profiles/x5679net/activity

https://divisionmidway.org/jobs/author/x5679net/

https://metaldevastationradio.com/x5679net

https://gitlab.aicrowd.com/x5679net

https://gitee.com/x5679net

https://forum.sinusbot.com/members/x5679net.98358/about

https://pbase.com/x5679net

https://jali.me/x5679net

https://linktr.ee/x5679net

https://fortunetelleroracle.com/profile/x5679net

https://www.openrec.tv/user/x5679net/about

https://www.shippingexplorer.net/en/user/x5679net/187994

https://golosknig.com/profile/x5679net/

https://www.claimajob.com/profiles/7050036-nha-cai-5679

https://redfernelectronics.co.uk/forums/users/x5679net/

https://vocal.media/authors/x5679net

https://spiderum.com/nguoi-dung/x5679net

https://fabble.cc/x5679net

https://www.maanation.com/x5679net

https://motion-gallery.net/users/819419

https://formulamasa.com/elearning/members/x5679net/

https://www.notebook.ai/users/1138318

https://rotorbuilds.com/profile/154775/

https://www.hoaxbuster.com/redacteur/x5679net

https://www.yourquote.in/trung-dang-d05yz/quotes

https://www.deafvideo.tv/vlogger/x5679net

https://www.max2play.com/en/forums/users/x5679net/

https://www.chaloke.com/forums/users/x5679net/

https://www.babelcube.com/user/nha-cai-5679-10

https://www.planet-casio.com/Fr/compte/voir_profil.php?membre=x5679net

https://unityroom.com/users/nedq6wj5xhg90mbcs1vr

https://www.rwaq.org/users/x5679net

https://linksta.cc/@x5679net

https://www.gta5-mods.com/users/x5679net

http://www.biblesupport.com/user/751489-x5679net/

https://djrankings.org/profile-x5679net

https://oyaschool.com/users/x5679net/

https://akniga.org/profile/1153292-x5679net/

https://matkafasi.com/user/x5679net

https://www.annuncigratuititalia.it/author/x5679net/

https://luvly.co/users/x5679net

https://www.socialbookmarkssite.com/bookmark/6039814/x5679net/

https://www.catapulta.me/users/x5679net

https://ketcau.com/member/95319-x5679net

https://www.bitsdujour.com/profiles/tusVlO

https://bitspower.com/support/user/x5679net

https://gravesales.com/author/x5679net/

https://dongnairaovat.com/members/x5679net.46520.html

https://www.syncdocs.com/forums/profile/x5679net

https://www.proko.com/@x5679net/activity

https://www.ebluejay.com/feedbacks/view_feedback/x5679net

https://www.niftygateway.com/@x5679net/

https://www.equinenow.com/farm/x5679net.htm

https://seomotionz.com/member.php?action=profile&uid=80650

https://acomics.ru/-x5679net

https://rant.li/x5679net/x5679net

https://www.remoteworker.co.uk/profiles/7050158-nha-cai-5679

https://fanclove.jp/profile/wyWebAM6B0

https://www.mountainproject.com/user/202109801/nha-cai

https://app.hellothematic.com/creator/profile/1041227

https://www.facer.io/u/x5679net

https://pc.poradna.net/users/1022075373-x5679net

https://www.upinoxtrades.com/group/upinox-trades-nigeri-group/discussion/c7e9ea41-5f96-41b3-aa0e-935217767abd

https://www.arriba420.com/group/weedlike2meetu/discussion/6fd022b5-8b16-407c-bddc-5cb1fe49f90f

https://www.chuckleinn.com/group/mysite-200-group/discussion/b33dfae0-6c77-41c6-804e-d1abf381e3c9

https://mentorship.healthyseminars.com/members/x5679net/

https://www.montessorijobsuk.co.uk/author/x5679net/

https://espritgames.com/members/48321588/

https://web.ggather.com/x5679net

https://3dwarehouse.sketchup.com/by/x5679net